Did you know that we have two companies (with different names) dedicated to separate lines of our business? Capitol Services houses our transactional business (corporate and UCC) and Capitol Corporate Services houses our registered agent business. This is why some of your invoices will contain different names or types of invoice numbers. Although CCS is generally our name for agent services, sometimes we provide the agent services under a different name due to name availability issues. To ensure that you list the correct name on your filing, please contact us before appointing us as agent or view the up-to-date list of names and addresses on your Client Dashboard.

Alerts

Social Enterprise Businesses Now Recognized

With business success no longer defined by profit alone, the number of social enterprise businesses continues to grow. In addition to financial performance, businesses today are valued by their impact on society. As a result, one or more social enterprise business entities are now recognized in most jurisdictions.

Benefit Corporations

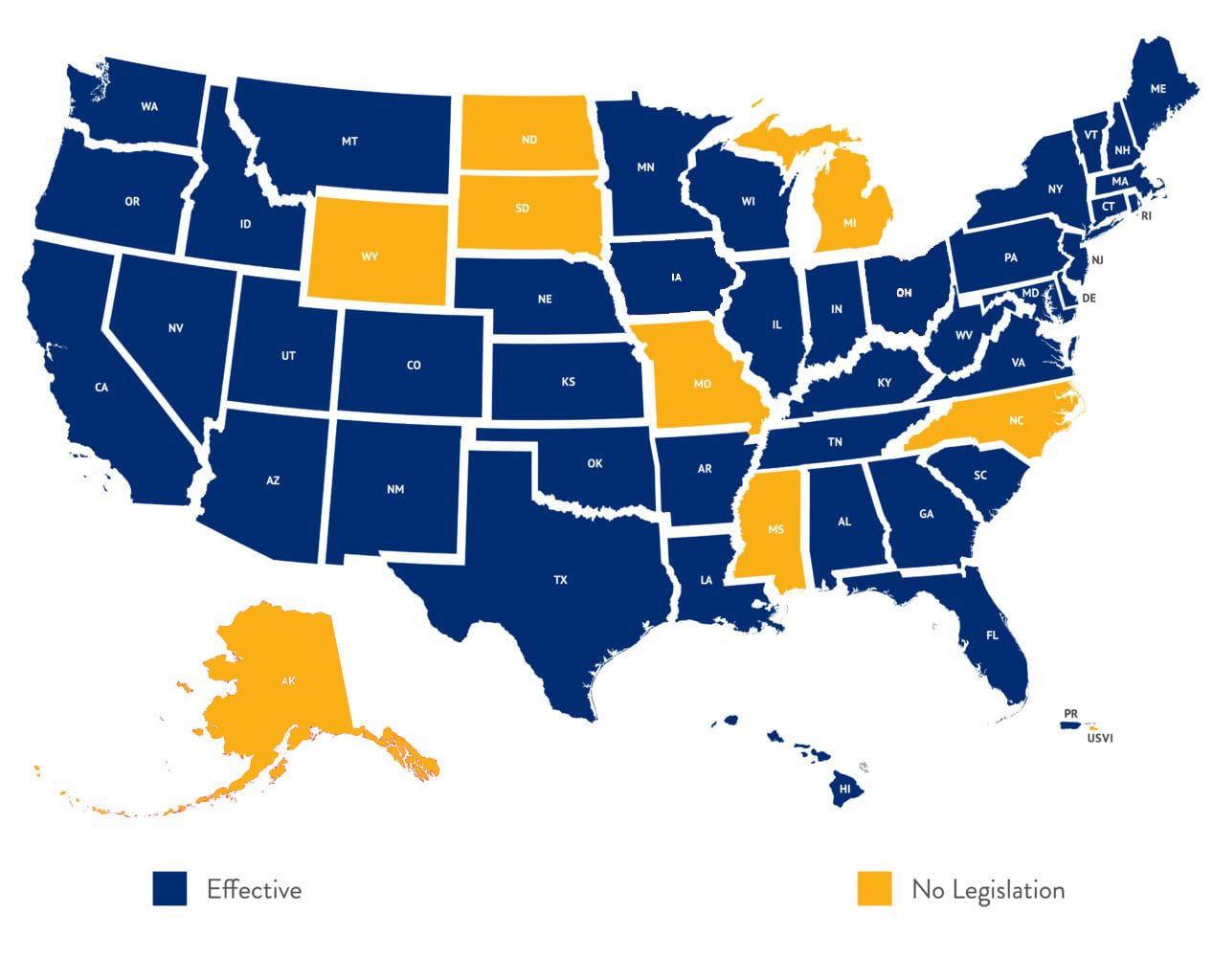

Making an initial appearance in 2010, benefit corporations are a fairly new type of business entity. This type of social enterprise entity is currently recognized in 43 states as well as D.C. and Puerto Rico. Benefit corporations pursue a mission that goes beyond that of the traditional corporation of solely making money for the shareholders. A benefit corporation’s leadership is required to achieve a public purpose while balancing shareholder interests with those of the employees, community, and environment.

In jurisdictions where benefit corporations are recognized, formation is achieved by filing traditional articles of incorporation that include a statement that the corporation is formed to provide for a general public benefit. With shareholder approval, an existing corporation can morph into a benefit corporation by filing amended or restated articles of incorporation. A corporation in a jurisdiction with no legislation permitting benefit corporations can domesticate to become a benefit corporation or form a new benefit corporation altogether in a jurisdiction where benefit corporations are recognized.

A “general public benefit” is defined as one having a material, positive impact on the environment or society. Several jurisdictions require a more stringent “specific public benefit” and define or give examples of permissible specific public benefits in their statutes. Other jurisdictions permit a combination of general benefit and one or more specific benefits.

In addition to meeting the same legal requirements as other for-profit entities, benefit corporations have to voluntarily and formally meet higher standards of corporate purpose, accountability, and transparency. One such transparency provision requires benefit corporations to publish annual benefit reports of their social and environmental performance as assessed by an independent, third-party standard. There is no legislative standard, but guidelines require it to be comprehensive, credible, transparent, and developed by an independent entity that has no material or financial interest in the use of the standard. Some jurisdictions have dropped the third-party standard requirement entirely. Currently there are several companies available to perform these third-party standard assessments, including some that cater to benefit corporations only.

Furthermore, some jurisdictions have an additional requirement that a benefit corporation file its annual benefit report at the Secretary of State along with its regular annual report. This extra filing often includes a fee. When the additional filing is required, noncompliance ranges from no penalty whatsoever to loss of status as a benefit corporation.

Delaware Public Benefit Corporation

Due to the importance of Delaware corporate law, it is worth noting that Delaware’s benefit corporation law differs from the majority. Not only does Delaware’s statute refer to a benefit corporation as a public benefit corporation (“PBC”), it mandates that a PBC pursue not only a general public benefit but designate a specific public benefit in its charter as well. Delaware also requires that a benefit report be made available biennially to shareholders rather than made publicly available. Delaware’s statute also allows the board to define its own standard for assessment of corporate activities and does not require a third-party assessment.

Social Purpose Corporations

A more flexible type of social enterprise entity is the social purpose corporation (“SPC”). SPCs are currently only recognized in a handful of states. Much like the benefit corporation, an SPC is required to consider factors other than shareholder profit. However, unlike the benefit corporation, the SPC does not require a general public benefit and is only required to consider special purposes as stated in its articles of incorporation, giving directors more flexibility in assigning different weight to factors as they deem appropriate. An SPC does not have a third-party assessment requirement but is required to post its annual social report on its website as well as distribute it to its shareholders.

Benefit LLC

The benefit LLC (“BLLC”), a lesser-known social enterprise entity type, also emerged in 2010 with analogous requirements to that of the benefit corporation. With a much slower adoption rate, BLLCs were only recognized in four states until 2018 when Delaware enacted its own public benefit LLC (“PBLLC”) legislation. Delaware’s PBLLC statute closely tracks its PBC statute, mandating both general and specific public benefits. While there is currently no pending BLLC legislation, it is reasonable to expect other jurisdictions will follow Delaware’s lead.

B Corps

Benefit corporations are often referred to as “B Corps.” However, a benefit corporation and a Certified B Corp are not one in the same. A benefit corporation is a business entity created under state law, similar to a traditional corporation. A Certified B Corp is a business that has been certified by B Lab, a non-profit organization. A business does not need to acquire a B Lab certification to form or convert to a benefit corporation. Additionally, any type of business entity in any jurisdiction can apply for B Lab certification.

Continuing to gain momentum, with legislation introduced in several states, social enterprise business entities provide a safe harbor for directors to pursue social benefits over profit. Additionally, they allow for the duration and protection of company values through unforeseen leadership change or acquisition. However, because not all jurisdictions recognize the different types of social enterprise entities, and because of the varied laws of those that do, there is still much unchartered legal territory in the world of social enterprise entities.

Jurisdictions that recognize (or have recently enacted legislation) benefit corporations or public benefit corporations are AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, MA, MD, ME, MN, MT, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, TN, TX, UT, VA, VT, WI, and WV. Jurisdictions that recognize social purpose corporations are CA, FL, TX, and WA. Jurisdictions that recognize BLLCs or PBLLCs are DE, MD, OK, OR, PA, and UT.

Clerks: File First or Maybe Second?

It is sometimes impossible to ensure that file first, file second instructions will be adhered to by state UCC filing offices. If filing order is imperative, please discuss the best submission methods with our customer service representatives. It may be necessary to wait for returned evidence of the first filing before submitting the second.

Independent Director Service Now Available

Structured finance transactions frequently call for the formation of a special purpose entity (SPE) to isolate assets and limit risks associated with bankruptcy. In addition, the appointment of an independent director or manager may be required to provide an independent vote regarding certain actions designated in the SPE’s operating agreement. An independent director or manager is not involved in the management of the SPE but is appointed to provide independent judgment upon a triggering event, such as insolvency.

Through a proven relationship with one of the nation’s top wealth advisory and financial firms for corporate transactions and restructuring, Capitol Services now has a trusted source for independent director and independent manager services.

You are accustomed to Capitol Services’ fast, reliable service to meet your transactional needs. You will experience the same level of service when you contact us for your independent director or manager needs.

E-Recording 411

Almost all U.S. states have passed statutes allowing for electronic or e-recording of real estate documents. We are happy to now offer an e-recording service in thousands of counties across the country.

In most cases, e-recording reduces fees and turnaround time for evidence of filing. Because we are able to get an almost immediate evidence of filing or rejection, there is no longer a concern that a filing office or delivery service will misplace an important document. Postage alone on large recording projects can add significant costs – especially if those large boxes are shipped to your service provider, a local filing office, and then back to your desk.

As we’ve seen with some Secretary of State requirements, it’s not impossible to imagine a day when real estate documents are required to be electronically transmitted. Take advantage of our e-recording service and ask us if your next filing is eligible!

Texas Franchise Tax Reports

Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts has extended the due date for 2021 Texas franchise tax reports to June 15, 2021. Learn more here: https://bit.ly/2NR2aVB.